Puhua Youce pH 2024-12-10 20:32 Beijing

Analysis of Development Trends, Industrial Chain Relationships, Competitive Landscape, and Market Concentration in the Motor Industry

1. Efficient and energy-saving motors will remain the main development trend in the motor industry in the future

The motor industry, due to its characteristics of being raw material intensive and labor-intensive, has undergone a process of transferring from industrialized countries to countries and regions with relatively cheap labor and raw materials. China's motor industry has seized the trend of global motor industry transfer, utilizing its advantages in labor and raw material costs, and has developed rapidly in recent years.

From the perspective of segmented markets, AC industrial motors occupy an important market position and are the main type of motor products in the global industrial motor industry. As a key equipment for converting electrical and mechanical energy, AC motors are widely used in manufacturing industries such as mining, metallurgy, oil and gas, and petrochemicals, and their growth is highly correlated with the prosperity of the manufacturing industry. In 2023, China's gross domestic product reached 126 trillion yuan, a year-on-year increase of 5.2%; The over all industrial economy is also showing a trend of recovery, with a total annual investment of about 16.2 trillion yuan, a year-on-year increase of 9%; The operating revenue of industrial enterprises above designated size was 133.4 trillion yuan, a year-on-year increase of 1.1%. The sustained and stable development of the domestic economy will also drive the downstream main application areas of the motor market to maintain stable growth, and the stable development of the downstream market ensures the demand of the motor market.

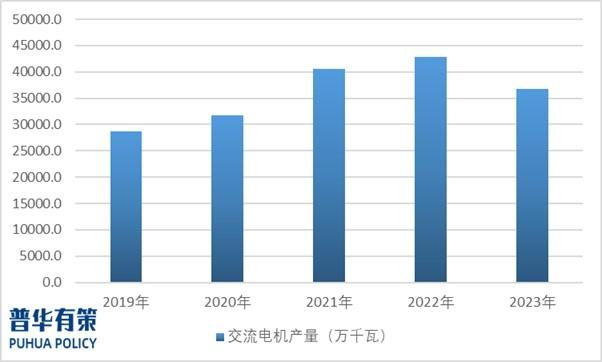

In 2023, China's output of AC motors reached 368.125 million kilowatts, with an average annual compound growth rate of 6.39% in the past five years.

Production of AC motors in China from 2019 to 2023

Source: National Bureau of Statistics, PwC Youce

In 2023, China's national economy will continue to improve and industrial production will further increase. According to the statistics of the Small and Medium sized Motor Branch of the China Electrical Equipment Industry Association, the added value of industries above designated size in China increased by 4.6% year-on-year, the manufacturing industry increased by 5.0% year-on-year, and the equipment manufacturing industry increased by 6.8% year-on-year; The industrial added value of the small and medium-sized motor industry increased by 5.5% year-on-year, which is 0.5 percentage points higher than the national manufacturing industry.

In the 21st century, countries around the world have attached great importance to carbon emission targets, and environmental awareness is becoming stronger. China has promised to peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060. Therefore, high-efficiency and energy-saving motors will still be the main development trend in the motor industry in the future. The motor efficiency specified in the national standard GB18613 "Minimum Allowable Values and Energy Efficiency Grades for Motors" and the IEC standard is gradually improving, providing impetus for the development of a new round of green, high-efficiency, energy-saving, and environmentally friendly motors.

2. Sales revenue and profit situation in the motor industry

Motor products are essential basic electromechanical components for industrial automation, office automation, home automation, and high-end equipment automation, with a wide range of downstream applications. In 2021, the entire motor industry achieved a sales revenue of 70.2 billion yuan and a profit of 3.40 billion yuan; In 2022, the entire industry achieved a sales revenue of 75.95 billion yuan and a profit of 4.14 billion yuan; In 2023, the industry's annual sales revenue was 79.07 billion yuan, with a profit of 4.8 billion yuan. In the past three years, the industry's sales revenue growth rate has reached 12.64%, and the profit growth rate has reached 41.18%.

3. Analysis of the Impact of Upstream and Downstream Industry Development

(1) Development status of upstream industries and their impact on the motor manufacturing industry

The raw materials for the motor industry mainly include copper (electromagnetic wire, enameled wire, etc.) and steel (silicon steel sheet, punching sheet, cold work parts, etc.) products. Changes in upstream raw material prices have a direct impact on the industry's product pricing policies, cost levels, and sales performance.

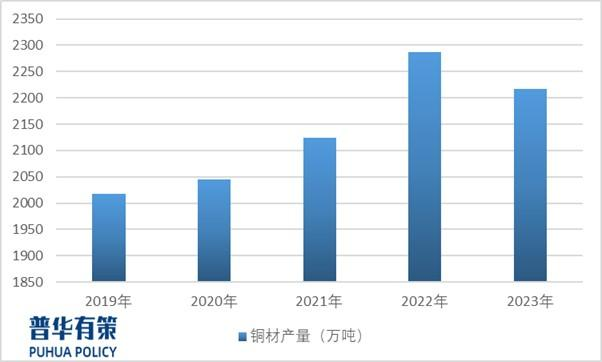

1) Copper industry

China is the world's largest producer and consumer of refined copper. With the rapid improvement of smelting capacity of copper production enterprises nationwide, China's copper production has increased from 2017.2 million tons in 2019 to 22.17 million tons in 2023, an increase of 9.90%.

China's copper production from 2019 to 2023

In recent years, the spot copper price in China has been continuously rising, from an average price of 47767.70 yuan/ton in 2019 to an average price of 68401.82 yuan/ton in 2023, an increase of 43.20%.

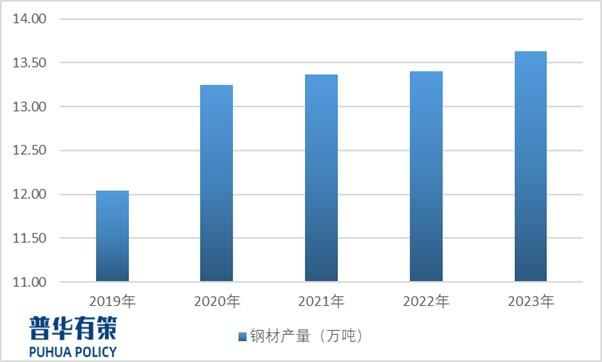

2) Steel industry

As one of the most important raw materials for motor products, steel production in China has shown a steady upward trend from 2019 to 2023, rising from 1.205 billion tons in 2019 to 1.363 billion tons in 2023

China's steel production from 2019 to 2023

From 2019 to 2023, the overall price of steel in China has steadily increased.

Development status of downstream industries and their impact on the motor manufacturing industry

Under the guidance of relevant national policies, the downstream main application areas of China's motor market have maintained stable growth. Motor products are widely used in various fields of the national economy, including machinery, coal, petrochemicals, lifting metallurgy, water conservancy and power, aerospace, pipeline transportation, ships, and nuclear power plants. The rapid development of related industries has provided a broad market space for the motor industry and promoted the orderly development of the entire motor industry.

4. Industry technical level and technical characteristics

The technical level and characteristics of the motor industry are mainly reflected in four aspects, namely: design technology, manufacturing technology, integration technology, and inspection technology.

The theory of electric motors is quite mature and mainly applied in product design. As an electromagnetic device, the physical phenomena of motors occur in the form of "fields", and traditional calculation methods based on "circuits" have low accuracy. Nowadays, finite element numerical analysis technology greatly improves design accuracy by calculating from the perspective of "field". This technology can be used for analysis of motor electromagnetic fields, temperature fields, bearing lubrication, ventilation systems, structural vibrations, and supports simulation of motor start-up, operation, overload, and other working conditions.

The manufacturing technology in the motor industry has significantly improved with the promotion of ERP digital management systems, involving automated CNC equipment, precision machining technology, automated electrical machining, and testing systems. The industry tends towards specialization and modular division of labor, and integrated technologies are constantly developing, such as generators, marine diesel generators, and high-voltage motors, which integrate various electrical and mechanical technologies to enhance performance and reliability.

In terms of inspection technology, mechanical properties and physicochemical testing of metal materials; Mechanical and electrical performance testing of insulation materials; Ultrasonic, magnetic particle, coloring and other methods for testing the quality of welds; Dimensional, shape, and positional tolerance testing of components; Interturn pulse, ground and phase to phase withstand voltage testing for winding production; Detection of VPI winding capacitance and leakage current; Dynamic balance detection of rotor (or armature); The comprehensive detection technologies for motor efficiency, power factor, maximum torque, starting torque, out of step torque, traction torque, noise, vibration, temperature rise, etc. are relatively mature.

5. Analysis of Industry Competition Pattern and Market Concentration

Electric motor products are widely used in various basic industries of the national economy and are indispensable power components in the industrial manufacturing field, with good equipment versatility. At present, there are many market participants in China's motor industry, and competition is fierce. Foreign brands such as Siemens (China) Co., Ltd. and ABB occupy a certain position in the mid to high end market. Local brands in the second tier, such as Jiadian Corporation and Wolong Electric Drive, focus on different production fields. The third tier are Chinese local industrial motor manufacturers mainly composed of small and medium-sized enterprises. These enterprises have low product prices, relatively serious product homogenization, and relatively poor product stability.

There is significant differentiation within the motor industry, with listed companies and large state-owned enterprises taking the lead in the industry's development due to sufficient funds, large production capacity, and high brand awareness, gradually expanding their market share.

The "Research and Analysis Report on the Development of Global and Chinese Electric Machinery Industry and the 15th Five Year Plan from 2025 to 2031" covers the industry's global and Chinese development overview, supply and demand data, market size, industrial policies/plans, related technologies, competitive landscape, upstream raw material situation, downstream main application market demand scale and prospects, regional structure, segmented products, market concentration, key enterprises/players, enterprise share, market outlook forecast, investment strategy, main barrier composition, related risks, and other contents. At the same time, Beijing Puhua Youce Information Consulting Co., Ltd. also provides market research projects, industry research reports, industry chain consulting, project feasibility study reports, specialized and innovative small giant certification, market share reports, 15th Five Year Plan, project post evaluation reports, BP business plans, industry maps, industry plans, blue and white papers, national manufacturing industry single champion enterprise certification, IPO fundraising feasibility studies, IPO working paper consulting and other services.